Car lease in Denmark

Getting a car today means a lot more things that outrun luxury. It can be exploring the countryside at leisure or more importantly because you need new means of commutation. Although many people think of buying a car, most of them back down in the midway only.

This is sometimes due to monetary reasons or deals that do not seem lucrative. Did you know that out of all people, ex-pats are the ones who find it way challenging to secure a car for them? So, if you happen to move to Denmark recently, then this article will help you get a good deal on the go.

List of car leasing companies in Denmark

› Hejoscar.dk

› One2movebiludlejning.d

› Sixt.dk

› Europcar.dk

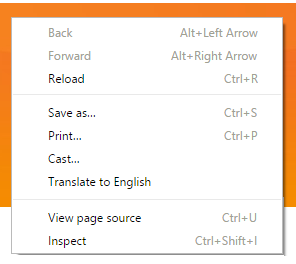

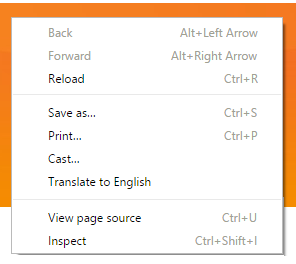

TIP: when you land on a Danish website that offers car leases, make a right mouse-click anywhere on the page (Only works with Google Chrome browser!). A small dropdown menu will appear and then it will say; “translate this page to English” (or any other preferred language). This will make it better understandable and easier for you to make the right decision!

TIP: when you land on a Danish website that offers car leases, make a right mouse-click anywhere on the page (Only works with Google Chrome browser!). A small dropdown menu will appear and then it will say; “translate this page to English” (or any other preferred language). This will make it better understandable and easier for you to make the right decision!

What are the basics of car lease in Denmark?

One of the prime aspects of leasing a car in Denmark will involve paying a deposit. This is taken in the form of a down payment and contribution towards the cost of the car. The buyer is then provided with a 36-months leasing contract. At the end of this period you usually have two options in hand:

1. Owner pays off residual value

This is one of the main points to be discussed during the initial days of the contract. If by any chance, the user has not driven the car for excessive kilometers, this fixed sum is paid off by you. From this point onwards, the contract terminates, and you own the car.

2. Keys are handed back to the company

In this type of situation, the car owner hands back the car’s keys to the company. This gets settled when you have paid off the additional costs for damages or excess kilometers. After the monetary settlement is done, the owner can lease another car for another set of the stipulated period.

Apart from the points mentioned above, there are other vital points to consider too:

1. The leasing company checks the car for any visible damage

Whenever it is time for the end of the contract, the leasing company will inspect the car keenly for any damages. Some of these even get so pedantic to get maximum money from you. Thus, before you lease a car, make sure to the homework in the best possible way.

2. Excess kilometers will be charged

Any excess kilometer driven by the car will bear you extra money. Make sure to stick to the exact number of kilometers mentioned in the contract to cut off any extra cost at the end of the contract.

Car leasing in Denmark is almost equivalent to buying a car. The price is quoted on the base model, and if you want any extras in your automobile, that have a different cost. However, there is a flip side to all of these. Luxury cars such as BMW tend to depreciate less for 36 months, and thus, the lease contract will have favorable monthly installments.

Why is leasing financially better?

Financial leasing is best for users because it helps you get a hold of a car at a relatively lower price. For all those who are self-employed, leasing acts as a smarter decision against buying. It is because the lease payments and kilometers can be considered deductible expenses against the income.

What are the benefits of leasing a car?

There are many benefits of leasing a car. While many people are still in a quandary about the option, it comes bearing gifts. Let us check out how leasing a car helps you in the long run:

1. Convenience

One of the main benefits of leasing a car is convenience. Almost all the terms and conditions are shared with users from the start. Also, there is no hassle of negotiating with used car dealers to trade the car.

2. Affordability:

Even if you are not rich, leasing a car gives an option of driving a brand new car at ease. All you need to do is pass the credit checks and pay off the monthly mortgage. Leasing also proves as a lesser hurdle than buying a new car.

3. Leverage:

When you lease a car, you do not have to invest a whole lot of money in it. Let’s not forget that a new car is a depreciating asset and does not make a financially sound investment.

Like all other things, there are some downsides to leasing a car which is mentioned below in points:

- Leased cars are difficult to service at local stores and need the aid of an Original Equipment Manufacturer.

- If, by any chance, you want to wiggle out of the contract before the tenure, then you still have to pay monthly installments. This carries out till the contract does not terminate.

- You don’t have legal ownership of the car.

FAQ about car leasing in Denmark

Leasing allows owners to get a new model at the end of the contract. This means cars are returned after the agreement, and after settling the mileage limit, you can easily go for another car.

Yes, one can easily sell the leased cars after the end of the contract. This means once you are off the hook, you can make the settlement and then look for other cars for lease.

There are fundamental differences between finance and leasing. While leasing involves a contract and an initial deposit, finance doesn’t need any of these. Other than that, while you lease a car, you do not need a bank loan, but it is necessary during finance.

The term leasing is used when you want to rent a car but for a longer duration. A contract binds the whole process, and one has to pay structured monthly mortgages until the end of the agreement.

| › Hejoscar.dk |

| › One2movebiludlejning.d |

| › Sixt.dk |

| › Europcar.dk |

TIP: when you land on a Danish website that offers car leases, make a right mouse-click anywhere on the page (Only works with Google Chrome browser!). A small dropdown menu will appear and then it will say; “translate this page to English” (or any other preferred language). This will make it better understandable and easier for you to make the right decision!

TIP: when you land on a Danish website that offers car leases, make a right mouse-click anywhere on the page (Only works with Google Chrome browser!). A small dropdown menu will appear and then it will say; “translate this page to English” (or any other preferred language). This will make it better understandable and easier for you to make the right decision! What are the basics of car lease in Denmark?

One of the prime aspects of leasing a car in Denmark will involve paying a deposit. This is taken in the form of a down payment and contribution towards the cost of the car. The buyer is then provided with a 36-months leasing contract. At the end of this period you usually have two options in hand:

1. Owner pays off residual value

This is one of the main points to be discussed during the initial days of the contract. If by any chance, the user has not driven the car for excessive kilometers, this fixed sum is paid off by you. From this point onwards, the contract terminates, and you own the car.

2. Keys are handed back to the company

In this type of situation, the car owner hands back the car’s keys to the company. This gets settled when you have paid off the additional costs for damages or excess kilometers. After the monetary settlement is done, the owner can lease another car for another set of the stipulated period.

Apart from the points mentioned above, there are other vital points to consider too:

1. The leasing company checks the car for any visible damage

Whenever it is time for the end of the contract, the leasing company will inspect the car keenly for any damages. Some of these even get so pedantic to get maximum money from you. Thus, before you lease a car, make sure to the homework in the best possible way.

2. Excess kilometers will be charged

Any excess kilometer driven by the car will bear you extra money. Make sure to stick to the exact number of kilometers mentioned in the contract to cut off any extra cost at the end of the contract.

Car leasing in Denmark is almost equivalent to buying a car. The price is quoted on the base model, and if you want any extras in your automobile, that have a different cost. However, there is a flip side to all of these. Luxury cars such as BMW tend to depreciate less for 36 months, and thus, the lease contract will have favorable monthly installments.

Why is leasing financially better?

Financial leasing is best for users because it helps you get a hold of a car at a relatively lower price. For all those who are self-employed, leasing acts as a smarter decision against buying. It is because the lease payments and kilometers can be considered deductible expenses against the income.

What are the benefits of leasing a car?

There are many benefits of leasing a car. While many people are still in a quandary about the option, it comes bearing gifts. Let us check out how leasing a car helps you in the long run:

1. Convenience

One of the main benefits of leasing a car is convenience. Almost all the terms and conditions are shared with users from the start. Also, there is no hassle of negotiating with used car dealers to trade the car.

2. Affordability:

Even if you are not rich, leasing a car gives an option of driving a brand new car at ease. All you need to do is pass the credit checks and pay off the monthly mortgage. Leasing also proves as a lesser hurdle than buying a new car.

3. Leverage:

When you lease a car, you do not have to invest a whole lot of money in it. Let’s not forget that a new car is a depreciating asset and does not make a financially sound investment.

Like all other things, there are some downsides to leasing a car which is mentioned below in points:

- Leased cars are difficult to service at local stores and need the aid of an Original Equipment Manufacturer.

- If, by any chance, you want to wiggle out of the contract before the tenure, then you still have to pay monthly installments. This carries out till the contract does not terminate.

- You don’t have legal ownership of the car.

FAQ about car leasing in Denmark

Leasing allows owners to get a new model at the end of the contract. This means cars are returned after the agreement, and after settling the mileage limit, you can easily go for another car.

Yes, one can easily sell the leased cars after the end of the contract. This means once you are off the hook, you can make the settlement and then look for other cars for lease.

There are fundamental differences between finance and leasing. While leasing involves a contract and an initial deposit, finance doesn’t need any of these. Other than that, while you lease a car, you do not need a bank loan, but it is necessary during finance.

The term leasing is used when you want to rent a car but for a longer duration. A contract binds the whole process, and one has to pay structured monthly mortgages until the end of the agreement.