Credit cards in Denmark

A lot of transactions in Denmark are done in Denmark with a credit card and less and less cash is used. It is therefore almost a must-have if you want to survive in Denmark. This is one of the first tasks in that you will have to arrange once you arrive in Denmark. You can get a different kind of credit cards issued by different banks at different costs and it is therefore easy to lose the overview. With our tips, we will ensure that you will sing up for the credit card that fits your needs.

Credit cards in Denmark

Mastercard or Visa Card

First, you would need to decide if you need a prepaid credit card or a credit card with a current account. Prepaid cards are in general easier to get but you will pay more fees. Having a bank account in Denmark will make your life easier since you won’t have to pay international fees for example.

Mastercard and Visa card are the most used cards in Denmark. They are widely accepted within Denmark and most banks offer one of those 2 cards. If you want to open a bank account in Denmark you would need a personal number – every bank requires this. Also, you would need your passport and proof of residence. Most of it can be done online. Internet banking is very common in Denmark and it can save you a lot of time. You have full control over your account. You can set and change your daily payment and withdrawal limits, immediately lock your card if it gets lost, reset your PIN, and enable or disable online or foreign payments.

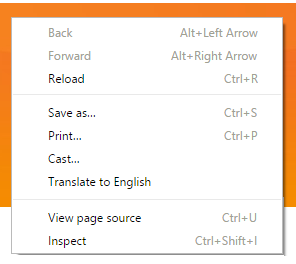

TIP: when you land on a Danish website that offers credit cards, make a right mouse-click anywhere on the page (Only works with Google Chrome browser!). A small dropdown menu will appear and then it will say; “translate this page to English” (or any other preferred language). This will make it better understandable and easier for you to make the right decision!

TIP: when you land on a Danish website that offers credit cards, make a right mouse-click anywhere on the page (Only works with Google Chrome browser!). A small dropdown menu will appear and then it will say; “translate this page to English” (or any other preferred language). This will make it better understandable and easier for you to make the right decision! Be aware that Borrowing money costs money

List of banks that offer Credit cards

| Credit Rate | Free Credit Card | Free Account | |

|---|---|---|---|

| › N26 | ✓ | ✓ | ✓ |

| › Banknorwegian.dk | ✓ | ✓ | ✓ |

| › Arbejdernes Landsbank | ✓ | ✘ | ✓ | › Sydbank | ✓ | ✓ | ✓ |

| › Spar Nord Bank A/S | ✓ | ✘ | ✓ |

| › Realkredit Danmark A/S | ✓ | ✘ | ✓ |

| › Danske Bank A/S | ✓ | ✓ | ✘ |

All listed banks in Denmark are of good quality, have good customer service and clear regulations. It is, however, difficult to know which bank and credit card is best for expats.

The best credit card in Denmark for expats

N26 is an online bank that used by most expats. This is a bank that offers a free Mastercard with a checking account. They do not have hidden costs since they are a purely online bank and they do not have the overhead costs of a brick and mortar bank. N26 was founded in 2013 in Germany and has rapidly become one of the largest online banks in Europe. They do not charge withdrawal fees within Europe and offer their website in English. You can easily have a look on their website and see if the conditions that they offer match your expectations.

N26 is an online bank that used by most expats. This is a bank that offers a free Mastercard with a checking account. They do not have hidden costs since they are a purely online bank and they do not have the overhead costs of a brick and mortar bank. N26 was founded in 2013 in Germany and has rapidly become one of the largest online banks in Europe. They do not charge withdrawal fees within Europe and offer their website in English. You can easily have a look on their website and see if the conditions that they offer match your expectations.

Resurs bank is a Danish bank with an excellent reputation in Scandinavia. Resurs bank offers a card that is accepted throughout Denmark and conditions that are understandable for non-Danish speakers. They offer a great customer service that offers their services in English. Resurs Bank offers low withdrawal costs and no hidden fees.

Resurs bank is a Danish bank with an excellent reputation in Scandinavia. Resurs bank offers a card that is accepted throughout Denmark and conditions that are understandable for non-Danish speakers. They offer a great customer service that offers their services in English. Resurs Bank offers low withdrawal costs and no hidden fees.